Getting Started With Quicken 2007 For Mac

As you work with QM2017, you may find there are many things that are still lacking compared to QM2007. I highly recommend that you browse through the IDEAS section of this forum and VOTE for the request of each of the missing features to be added back into Quicken for Mac.to help direct the priorities of the developers.

Quicken 2007 For Mac Sierra

To do that, I suggest you read this FAQ on how to filter the IDEAS to just show the ones for the Mac version, then VOTE to your heart's content: The following are some of the many feature requests you will find:. Budget features. Christmas border christmas clipart borders free for mac. many requests for configuration options and many others. Be sure to scroll down each page, as some contain lists of related features. Click on the link to EACH IDEA separately that you are interested in, then click the VOTE button at the top of EACH page that opens up respectively to increase the count and therefore its visibility to the developers. If you do not click VOTE at the top of the page of each feature, your vote will NOT be counted for THAT specific feature!

(If you find this reply helpful, please be sure to click 'Like', so others will know, thanks.).

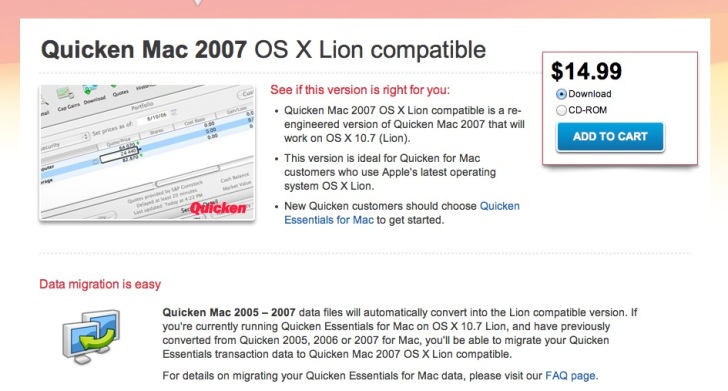

The coming of “” 32bit app usage in the fall 2018 macOS release finally forced my hand: I was going to have to update my single longest-used app, Quicken 2007. I’ve been using Quicken in some form since 1994, but stopped with Quicken 2007—I found the newer versions worse than Quicken 2007, so I never upgraded. Yes, I was using an eleven-year-old app to track our family’s spending and investments.

Basically because it worked (most of the time), and I didn’t like any of the alternatives, which I would occasionally test. But Quicken 2007 was showing its age. In addition to its 32bitness, it had other issues: The UI was tiny and horrid, the windows never opened where I closed them (‘s saved layouts to the rescue!), and online access to my accounts was nearly non-existent. Worst of all, it would crash on occasion, necessitating rebuilding all my data files.

It was finally time to find its replacement. After —and asking on Twitter—I focused on three apps:,. After looking at all three, I surprised myself by deciding that Quicken was the best tool for our use.

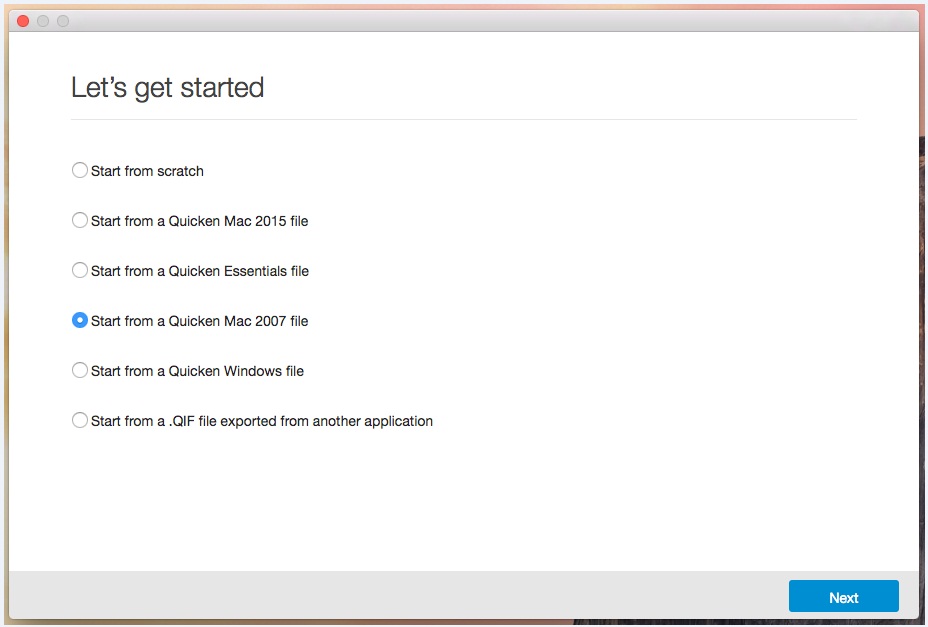

Going in, I was dead set against it, mainly due to its annual subscription structure. (I hate subscription software in general, but as it turns out, this one.) Read on for brief overviews of each of these three apps (with more detail on Quicken) and my rationale for deciding on Quicken. Getting started I was looking for an app that. Imported our historical Quicken data I didn’t want to lose 24+ years of our financial data. Felt like a Mac app I wasn’t interested in something that felt like a port from Windows, or lacked the specific “Macness” one gets in an app written for the Mac.M. Offered accurate investment tracking Our investments are in a few accounts, and I like to monitor them all in one spot. Included online account access I want to update our bank, credit card, and investment accounts from the source, instead of having to manually enter transactions.

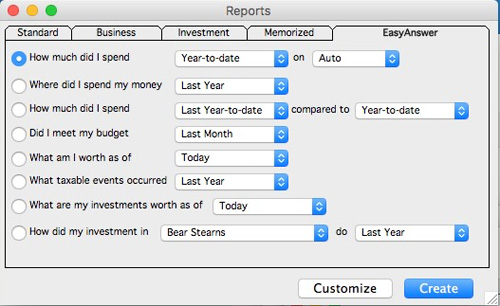

Things I don’t really care about are bill pay (I use our bank), reports, budgets, and charts and graphs for anything outside the investments section of the app. As such, I can’t vouch for how well any of these three programs handle those tasks. All three apps imported my Quicken data file, though with varying degrees of success. Moneydance ignored the “hidden” status of accounts, so a lot of old, closed accounts showed up. Banktivity won’t import reconciliations, so none of my accounts were reconciled. Still, these are relatively minor issues compared to successfully importing nearly 25 years worth of Quicken data. Now, here’s a brief overview of each of the three apps 3 – Moneydance This was the first app I looked at, and I pretty quickly ruled it out.

I found the interface not to my liking—there are icons next to each account, which makes the layout look busy, and I found its register view confusing: Notice that entries take up two rows, but the white/blue background alternates every other rowso if you’re glancing at the register, it’s nearly impossible to pick out one transaction unless you click on it to select it. (It’s easy to tell them apart in this four-line partial register, but in the full register with comments on the second line for many entries, everything blends together.) Moneydance is a Java app. And while that doesn’t inherently make it bad, Java’s generic “write once for many platforms” code shows itself in a few places: The Preferences window doesn’t look anything like a native Mac app window, and the buttons in the app are definitely not macOS-style buttons. Performance-wise, the app feels a bit slow; it takes a couple of seconds to open an account in a new window after double-clicking its entry in the account list.

This is true even if it’s an account I just opened and then closed. Due to these issues, I quickly decided that Moneydance was not for me. 2 – Banktivity Banktivity was a strong contender; it was neck and neck with Quicken until I got more into the transition and looked closely at all of our accounts. Its account list view is also laden with icons—folder icons, new activity count badges, and status badges.

Quicken 2007 For Mac Support

It looks very busy, but once you get into an account, the view is much cleaner than Moneydance: This view can also be infested with icons, but those can (thankfully) be disabled in the app’s preferences. In the register view, each entry is two rows, but the alternating background is also two rows, making it easy to see each transaction at a glance. Banktivity has two methods of data download: OFX (free) and Direct Access (subscription required). While many of our accounts offered free OFX support, there were a number that only worked with Direct Access, which is free during the generous 30 day trial period. Outside of that, Direct Access is a $45 per year subscription. Banktivity doesn’t have any of the “non-native” issues I found in Moneydance; the app looks and feels like a traditional Mac app, and opening an account window from the account list is speedy. Unfortunately, you can’t do that with a double-click, as that brings up the account’s info panel; you need to right-click and choose Open in New Window from the contextual menu.

That’s a big time waster for me. On the investment side, I had issues with two stocks that had had stock splits.

Because I wasn’t downloading investment data in Quicken 2007, I had manually entered the splits using Quicken’s split tool. Banktivity didn’t handle this correctly, so our balances were way off in those two accounts. In the end, I decided against using Banktivity due to its cost ($65 up front, plus $45 per year), the overabundance of icons in the layouts, its inability to import reconciliations from Quicken, and its difficulties handling some investment data.

1 – Quicken 2018 When Quicken 2018 was released as a subscription product, I with the change, as I have a big issue with “software as a service.” But as I dug into the app, I discovered that their subscription: If you stop subscribing, you can still use the app to enter and track financial data; you just lose access to the online components and Quicken’s support services. That allayed my fears of needing to subscribe forever, just so I wouldn’t lose access to my financial data. Unfortunately, there’s no free trial of Quicken, but they do offer a 30-day money back guarantee, so I paid and started testing. What I found is an app that, for the most part, takes everything I liked about Quicken 2007 and modernizes it. As I hoped, Quicken handled the import of my old data perfectly, bringing across the reconciliations and handling investments properly. It’s also speedy, opening new account windows promptly when double-clicked.

I like the minimalist one-line register views—they’re clean and easy to read: (If you need to see the details, you can double-click to see an expanded view.) You can choose one of four levels of line spacing for the register—they include Comfortable, Cozy (pictured), Compact, and Tiny. None of these affect the font size, just the row spacing. (I wish the font size were changeable, but it’s not.) Unique to Quicken among these three apps is the ability to change the visible columns, as well as the column order, on a per-register basis. As seen at right, there are a large number of columns you can choose to view—24 in total. I like that it’s just as easy to hide columns you don’t want to see. Once you’ve added and removed columns to your liking, you can drag the remaining visible columns into any order you wish.

Quicken includes two methods of online access: Direct Connect and Quicken Connect. Both are included in your annual subscription cost, and between the two, I was able to get all but one of my accounts working for online access. (Oddly, that one account did work with Banktivity.) Why I chose Quicken Certainly there’s some value to continuing with the app I had been using: The import went perfectly, and I felt immediately comfortable in the app.

But given how horrid Quicken was for many years of Intuit’s onwership, I was prepared to be disappointed. But Quicken is no longer owned by Intuit—two years ago, they were. That’s both good and bad; it’s good that they’re out from under Intuit’s lack of interest in the Mac app.

But it’s possibly bad in that an investment group only buys a company for one reason: To later sell it at a big profit. But to get to the point where the company is worth a higher valuation, they have to offer things that customers want. And to me, it seems “new Quicken” is trying hard. After buying, I received an email thank-you from the CEO, explaining where they’ve been and where they’re trying to go, and thanking me for being a customer—sure, it’s a form letter, but it’s more than I ever got from Intuit. The in-app help options, as seen at right, are extensive and include a link to the community forums as well as an in-app screen sharing feature. The help file itself is detailed and well indexed, making it fairly easy to find what you want.

(Though it is a complex app, so there’s a lot to look through.) The app is a real Mac app, with none of the weirdness that comes from a Java app. Buttons look right, the prefs look right, shortcut keys work as expected, etc. Finally, there’s the issue of cost. Quicken for Mac comes in three versions: Starter ($35/year), Deluxe ($50/year), and Premier ($75/year). The lays out all the differences. For us, as we need to track loans and investments but don’t need bill pay, Deluxe was the obvious choice.

Right now—and probably for quite a while, I’d imagine—a two-year Deluxe subscription is $69.98, bringing the cost per year to $34.99, which is a bargain. By comparison, the first two years of Banktivity would cost us $155, or $77.50 per year. If there are no more discounts after the first two years, Quicken will then cost us $5 more per year than would Banktivity, which means it would take roughly 17 years to spend the $85 we save up front. Quicken 2018 isn’t perfect, but for us, at least, it’s a very nice upgrade from Quicken 2007, and its reasonable cost and “not-really-a-subscription subscription” model work well for our family. Wyn: I’d never heard of them, so thanks for the pointer.

However I’m one of “those” people: I despise web apps, and can’t use them, and that seems to be what they are now? (Their prior version was a traditional Mac app, it appears.) Beyond that, if I’m reading the site correctly, all my data is stored on their server somewhere? That’s also not for me—I want my financial data on my machine, away from the cloud.

It may be the most amazing solution ever, but those two things will stop me from ever using it. Regards; -rob.

It still feels like some sort of weird black magic when I enter a redeem code on Movies Anywhere, and then watch as. 'is an innovative VDR, designed for today's M&A.' Where do I sign up? And after I sign up, will someon.

Not that I know of, unfortunately. I don't actually use it myself—lots of better ways to move and file things. But the fact that it behaves di. Stupid macOS limitation: If you want to use drag-and-drop from a folder in the Dock, you must view as Fan or Grid.